Part 1: The USA

Key Takeaways:

- Official growth data such as industrial production are delayed by 1 month+ in the US and survey measures are also delayed by 3+ weeks

- MacroX provides a real-time and accurate Nowcast of US industrial growth

- Due to its use of alternative data (satellite, sensor, news, etc.), MacroX’s Nowcast contains unique information

Industrial production and manufacturing data are crucially related to growth, which explains why even for developed countries where manufacturing is not a big part of the GDP, investors still pay attention to them. However, economic data measuring this sector is either delayed or, in some countries, doesn’t exist. At MacroX, we believe that alternative data and AI can help solve this problem and provide real-time and accurate insights into the macroeconomy. Our simple intuition is that satellites and sensors, for instance, contain more information about production than can be fully conveyed in a simple survey. In this series of blogs, we illustrate the usefulness of alternative data in measuring economic activity worldwide. Today’s post looks at an example of a developed economy; the USA.

All measures of US Industrial Production are delayed

Investors pay a great deal of attention to measures of industrial activity as reflected by the Bloomberg economic calendar rating these data releases as “most important”. Unfortunately, investors keen to know the state of US manufacturing in April 2023 are suffering from a dearth of information as these manufacturing data tend to be released well after the fact. The official data for the current month are released in the middle of the next month i.e. industrial production and manufacturing data for April will be released on May 16th.

Various purchasing manager surveys (PMIs) can mitigate the speed problem somewhat; indeed, the first data release investors will be able to see for April is S&P’s flash Manufacturing PMI released tomorrow (04/21). Market participants give more prominence to The Institute of Supply Management (ISM) PMI but this isn’t released until the first business day of the next month (the release for April data is 05/01). Of course, for a more concentrated measure, there is the Philly Fed Manufacturing Index which was released today (04/20) but only surveys 250 Philadelphia-based manufacturers.

MacroX’s Industrial Growth Nowcast is Real-Time

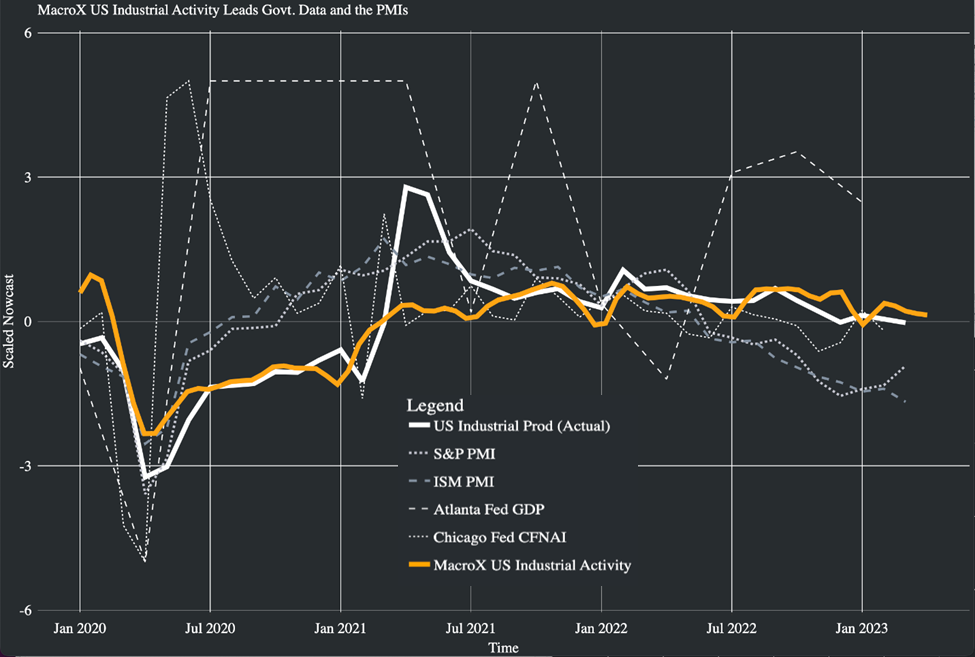

At MacroX, we generated a US industrial growth signal from many alternative data sources such as satellite, sensor, social, news, web, microdata, etc. fed into our AI-based nowcasting models shown in the golden line in Figure 1. As can be seen in the chart below, our Nowcast closely tracks the official government data (white line) with one key advantage; it’s available in real-time.

Figure 1: MacroX’s alternative data based industrial growth leads the government data by a month, and the S&P and ISM PMI by more than 2 weeks. It also leads broader measures such as the Atlanta Fed GDPNow and Chicago Fed national activity index.

Alternative Data generated Nowcasts are accurate and contain unique information

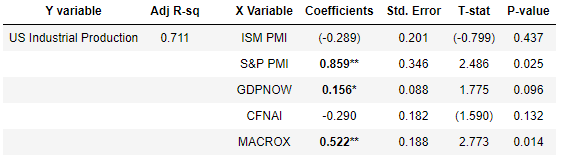

To test the accuracy of our Nowcast, we regressed US Industrial Production growth on our Nowcast and various other measures of activity.

Table 1: Scaled Regression of US Industrial Production growth on various PMIs, Fed Nowcasts and on MacroX’s measure of industrial activity. * indicates a coefficient significant at the 10% level, ** indicates a coefficient significant at the 5% level.

The relationship between the official industrial production data and the alternative data-based nowcast is economically and statistically significant even after we control for OTHER data. It is economically significant as the coefficient of 0.522 indicates a sizeable relationship between our Nowcast and the official data. The fact that the coefficient is also statistically significant demonstrates the uniqueness of the information alternative data provides and shows its value is additive to other, more traditional measures of activity.

Conclusion

The MacroX Nowcast generated by alternative data and AI is not only faster at measuring industrial activity in the US than more conventional measures but is accurate and contains unique information. In forthcoming blogs in this series, we will examine whether this remains the case in emerging and frontier economies (spoiler, it is even better!)